Things that Professional Traders Do Well

Things that Professional Traders Do Well

If you are just getting into trading, whether it be Forex trading, crypto, currency trading, the stock market or anything in between, the fact of the matter is that if you are a beginner, you probably don’t know how to trade. Of course, getting a good trading education is going to help a whole lot, but with that being said, no matter what kind of education you have, there are always things that professional traders do that newbies don’t.

In other words, what we are here to talk about today are the things that professional traders do very well. The things that professional traders do in order to profit. Of course, making profits is a big part of the equation, but minimizing risk is another part. As somebody who is just getting into the world of trading, there are many different tips and rules that you need to follow in order to be profitable and successful. Today, we’re here to talk about some of the things that professional traders do to make money, things that losers often forget to do.

Things That Make Money for Professional Traders

Right now, we want to talk about some of the most crucial things that you as a trader need to do in order to be profitable. These are all things that professional traders do on a daily basis.

Be Independent

One of the absolute worst things that you could possibly do in trading is to not be independent. There are all too many newbies out there who will go to various social media platforms, forums, and other unreliable sources of information. For tips and advice on trading. Most people will ask simple questions that can be answered through nothing more than a bit of research and testing. A lot of people will ask what is the best of this for that and so on and so forth.

You should not be asking what or when, but you should be asking why the fact of the matter is that there is no best trading strategy for any given situation, but a certain strategy may be best for a given situation based on a variety of factors. Therefore, you always need to be asking yourself why a specific trading strategy works or why a specific event occurred. You need to be able to think independently to create your own hypothesis and to test them by yourself as well.

You Need to be Willing to Put in the Work

One thing that professional traders do very well is to put in the required work, especially when it comes to testing out various trading strategies. For instance, one thing that you might ask yourself is whether a 10 week breakout or a 50 week breakout is better in terms of your returns relative to the risk. A lot of newbie traders might be tempted to just go online and type this question into Google.

However, the answers you get are going to be extremely varied depending on who wrote them and what situation they are talking about. Therefore what you need to be able to do is to go do some back testing. You need to be able to analyze both of those time periods for a variety of stocks and then come to your own conclusion. You have to get your hands dirty and be willing to do the work on your own, always relying on others for answers and information just isn’t going to work over the long run.

Managing Expectations

Yet another thing that professional traders do very well is to manage their expectations. Many newbie traders expect that they will be able to make a huge profit every single day and to be able to grow their trading account to 7 or even eight figures within just a couple of months. However, the unfortunate reality is that this just is not how life works.

When it comes to trading, sure you might get lucky, but the simple reality is that 99.9% of traders will completely bottom up and blow out their accounts by attempting to do this. Remember, trading is a marathon, not a sprint, and this means that you need to be calculated and you need to take your time. The simple fact of the matter is that you’re just not going to make profits every single day.

Managing Risk

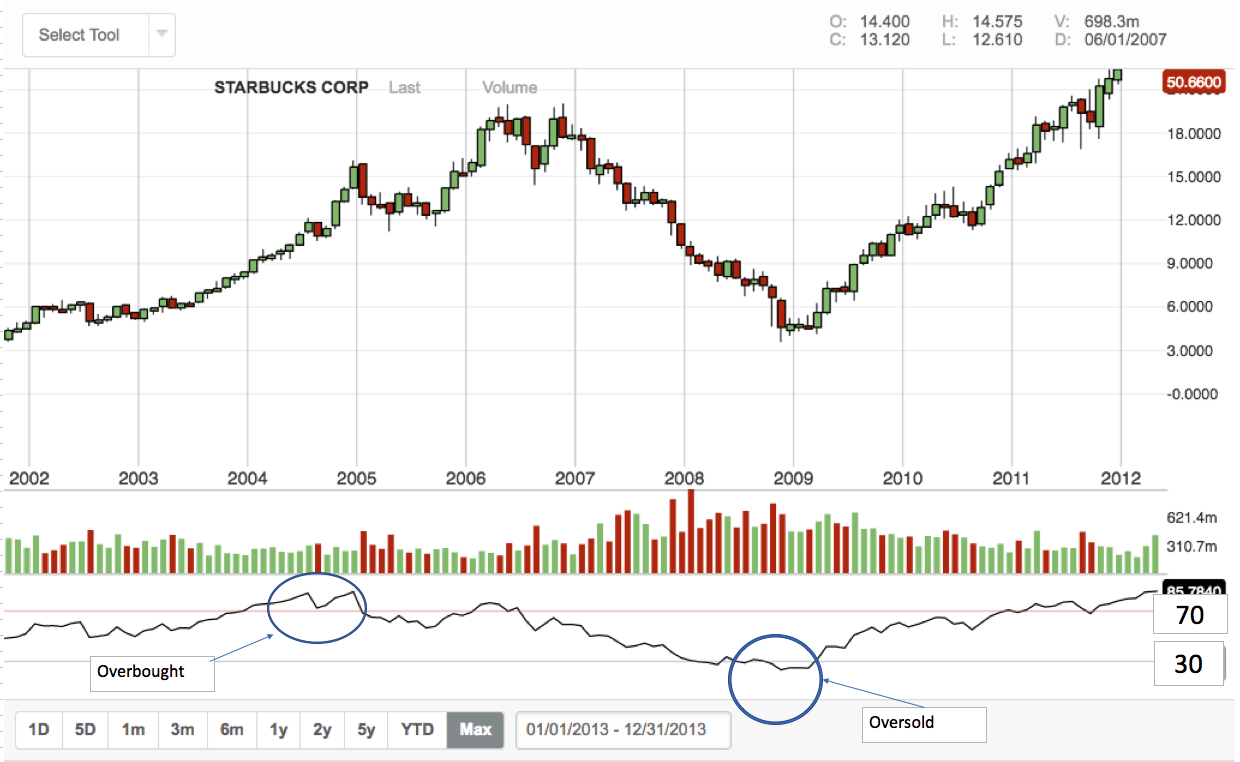

The next thing that professional traders do extremely well is to manage risk. What you need to know here is that no range sustains all of the time that no market trends all of the time, and that no strategy works all of the time, and therefore you need to be able to manage your risk appropriately.

This means that you need to know how to size your positions, how to use reduced leverage, and how to use stop loss.

Moreover, you also need to consider how much of your total trading capital that you want to invest for trade. Most professional traders will never invest more than two percent of their trading capital into a single trade. Therefore, if you lose a trade, at least you don’t lose all that much money.

Keeping Emotions in Check

The other thing that you need to be able to do, something that all professional traders do very well, is to keep your emotions in check. Folks, emotions have no place in trading, none whatsoever. Trading is all about logical thought and reasonable deduction. Nothing more, and nothing less.

If you are on a winning streak, don’t get too overzealous, happy, and start placing huge trades, because losses are always around the corner.

On the other hand, don’t be too discouraged if you lose a few trades, because there are always greener pastures ahead. Stay calm, cool, and collected, and if you are using a proven trading strategy, stick to it. Remember folks, consistency is key.

Trading as Professional Traders Do – Final Thoughts

The bottom line is that if you want to emulate the results that real professional traders can achieve on a daily basis, starting with the above rules and tips is definitely a good way to go.

If you need help day trading, and what you need is a comprehensive education, particularly on Forex trading, then the best place to be is the Income Mentor Box Day Trading Academy. At this time, the IMB Academy is the most comprehensive, user friendly, effective, and affordable Forex trading school out there.

/GettyImages-699097867-7277b42432f6473c9844a656d0014712.jpg)

/dotdash_Final_Top_Technical_Indicators_for_Rookie_Traders_Sep_2020-01-65454aefbc9042ef98df266def257fa3.jpg)

:max_bytes(150000):strip_icc()/ZigZag-5c643b96c9e77c0001566e88.png)